Chinese Social Media Stars as Global Celebrity

China’s internet celebrities may be one step closer to international fame.

BMG, the music division of European media giant Bertelsmann SE that’s worked with the Rolling Stones and Avril Lavigne, has begun a talent hunt on Momo Inc.’s live-streaming service, hoping to ferret out aspiring Chinese artists ready for the big time. The two companies unveiled a deal Monday to pick and groom about a dozen hopefuls a year from among the million or so amateurs who already gamely sing, dance and otherwise strive to entertain Momo’s 85 million Chinese users.

Momo — which started out as a dating network — is among the largest of the hundreds of livestreaming apps that’ve sprung up across China in past years. Hundreds of millions tune in to watch anyone from impoverished rural dwellers to celebrities eat, chat and perform in return for gifts of cash — a growing phenomenon fueled by the widespread adoption of digital wallets and a desire for lighter fare away from state-controlled TV. Some of the more popular entertainers command millions of followers.

“I didn’t understand the lyrics,” said Thomas Scherer, Global Vice President of BMG, addressing two of the singers. But “you both have amazing voices.”

BMG, who will work with local entertainment conglomerates Taihe Music Group and Huayi Brothers among others, will be among the first to try and bring the milieu’s most popular stars to the global mainstream. Momo will host an annual online competition that its users vote on; the tally, plus performers’ followers, help determine the final winners. Over the course of the year, BMG will help groom them for a possible contract and global debut. The chosen will head to Hollywood for vocal training, dance lessons and coaching on the business side of the recording industry, Scherer said.

Record labels have embraced streaming as a means to revive flagging revenues, particularly in China, where digital music stores have helped curb rampant piracy. But they’ve less of a track record of working with the growing number of hobbyists who broadcast their activities to followers online. China itself has produced few Mandarin recording artists who enjoy global acclaim.

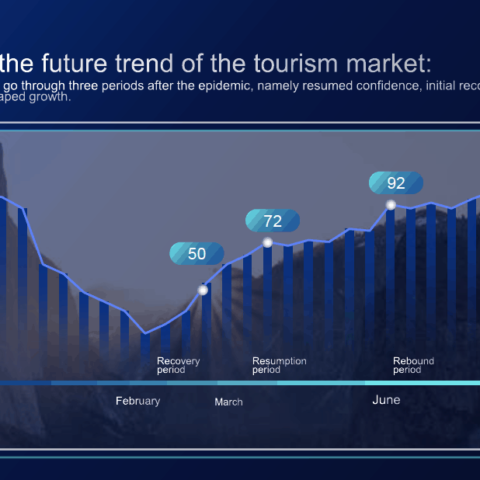

BMG may be looking at a potentially rich new well of talent, plus a sizeable built-in audience. China’s livestream apps now serve at least 200 million monthly active users, according to PriceWaterhouseCoopers. And Credit Suisse projects the nascent livestreaming market to be worth $5 billion by the end of 2017 — not far off annual Chinese film box office. From Weibo Corp. to Alibaba Group Holding Ltd., the country’s largest internet firms are also getting in on the act.

But the streaming ecosystem is getting increasingly crowded as a result, with more than 200 apps offering live video. Analysts expect the competition to thin.

Leave a Comment