Chinese tourism market post-outbreak

Ctrip and another of China’s biggest travel portals, Mafengwo, conducted a survey to assess consumer travel demands understanding the China tourism market post-outbreak

The survey was done in the form of a wish list. Thousands participated and signaled a clear travel demand.

Ctrip, one of China’s biggest OTAs is proactively taking strategic steps in anticipation of the impending strong travel rebound.

“The pandemic did not kill travel demand. It only postponed it.” – Sun Jie, Ctrip’s CEO

Ctrip recently released and shared with us its travel revival report. It includes positive trends and promising data and shows Ctrip’s confidence in China’s travel economy for the months ahead.

Using its own big data, Ctrip also compiled a list of overseas destinations categorized by theme along with the countries of greatest interest to Chinese travelers.

Trends in Chinese traveler behavior after similar outbreaks

According to previous data from similar outbreaks like SARS and MERS, Chinese travel demand experienced a strong rebound.

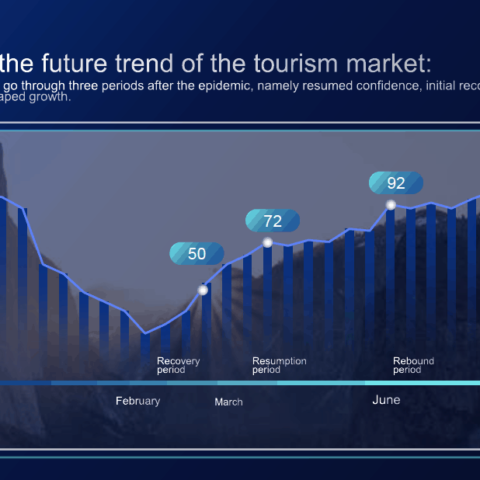

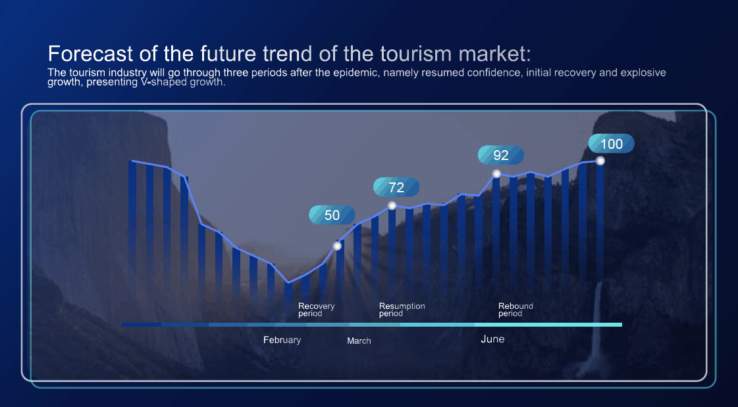

Based on its social media trends and data findings, Ctrip prepared a V-shaped, 3-phased road to recovery. They also improved their marketing efforts to provide better services to their users and brand marketers alike.

Ctrip’s Forecast for 2020: China’s tourism market post-outbreak

The 3 phases of Ctrips road to recovery include:

- Resumed confidence: February to March

- Initial recovery: March to June

- Explosive growth: June to August

This coincides with Chinese National Day in October where travel demand is expected to peak. Domestic travel is expected to recover the quickest, followed by international travel.

Phase 1: Resumed Confidence (February to March)

In this phase, Ctrip worked with other social media platforms and KOLs to put out soft-sell travel content. Brands can use this to reach out to their target audience. The idea is to increase the frequency of user-generated content and capture user aspiration.

This phase is also known as “种草”, a term that describes planting a seed in users’ minds to grow their desire. One such example is “cloud traveling”, where brands create beautiful, compelling content and imagery that helps users feel as if they are actually visiting a destination—but of course it’s virtual.

Phase 2: Initial Recovery (March to June)

During the initial recovery period, Ctrip will launch a pre-sale of tickets and support these sales with strong customer service.

The pre-sale includes domestic and overseas tickets for flights, hotels, and attractions. As price competitiveness is one of Ctrip’s core competencies, the pre-sale tickets launched at a discount of up to 50%.

To encourage users to get on board, Ctrip has launched a new service guarantee for worry-free refunds and additional safety measures.

Phase 3: Explosive Growth (June to August)

In anticipation of the summer holidays leading up to another of China’s biggest holidays, National Day in October, Ctrip will release a series of closed-loop marketing activities through online and offline channels to further promote user interest in travel.

***

In addition to Ctrip, there are other online travel portals, such as Mafengwo, that have shaped their marketing plans in anticipation for the rebound of Chinese travelers, starting from domestic travel leading up to international travel.

Want to be ready for the National Day in October? Contact us

Leave a Comment