eCommerce in China and Social Networks

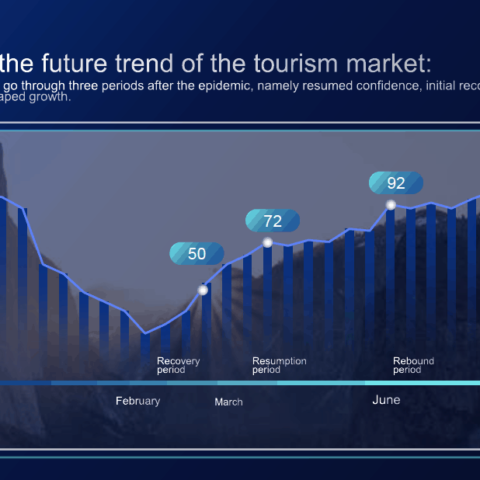

With a forecasted compound annual growth rate in double digits, online retailing is expected to grow from 17% of total retail sales in 2017 to 25% by 20201. The current scale and growth trajectory has made eCommerce a top three strategic priority for most retailers and brands. But more importantly, China’s eCommerce market offers a glimpse to the future of global retailing.

China, today, is characterised by mobile-first consumerbehaviour, vibrant social commerce adoption, and aubiquitous digital payments infrastructure. In addition, the market is fiercely competitive. Local and internationalbrands compete for consumer’s attention and wallet share, the internet giants race to build broad digital ecosystems to strengthen their existing network effects, and well-fundedstart-ups redefine customer experience. Only the mostinnovative survive in this dynamic retail environment.

In some ways the future sounds familiar as eCommerce remains the clear growth story. In the past however, capturing this growth typically meant the transactional elements of activating online channels, optimising merchandising, and investing in traffic generation. Yes, these core tenants still apply but China’s eCommerce market is a constantly moving target, and we are now entering an era of experience led commerce. As the lines between eCommerce, mobile and social have blurred, so will we see a broader convergence between online and offline retailing. In this way digital becomes a platform for not just online growth but everything from, brand building and customer engagement through to supply chain operations and physical store formats.

In China, the internet is mobile. PwC’s Total Retail 2017survey shows that 52% of Chinese consumers shop using their mobile/smartphone on a weekly or daily basis, as compared to 14% of consumers globally. Within only 4years this trend has come to characterise the eCommerce landscape in China. Alibaba’s mobile penetration of grossmerchandise value has grown from 6% in 2013 to 80% inDecember 201610, making desktop almost irrelevant.

If the internet means mobile, then WeChat is the de facto mobile platform. With over 800 million monthly active users, it is almost a proxy for mobile internet penetration in China. As with eCommerce, where third party platforms dominate, retailers and brands have come to recognise that capturing consumer’s attention typically means operating within the WeChat environment, versus building a direct-to-consumer mobile app. Many retailers, including Coach, Estée Lauder and Gap, have embedded their loyalty programmes within the WeChat app and now run customer relationship management(CRM) and engagement through the platform itself. This is

an effective strategy. Our Total Retail 2017 survey revealedthat 41% of Chinese consumers (34% globally) use socialplatforms as a way to receive promotional offers.

Want to know more about how to connect with Chinese consumers? http://chinasocialmedia.net/contact-page/

Leave a Comment