Many luxury brands are looking for the trend towards e-commerce with a degree of trepidation, but ultimately it seems anybody can resist succumbing to the allure of online retail. At the beginning of this year, LVMH set up a new e-commerce platform named 24 Sèvres to host all of its brands. Meanwhile, WeChat, China’s most popular messaging app, has become a testing ground for luxury e-commerce expansion, with Dior, Bulgari and Burberry among those early to adopt WeChat sales.

As global fashion companies and consumers are slowly adapting to the idea of shopping for luxury goods online, their Chinese counterparts have already made significant progress in popularizing luxury e-commerce. According to a 2016 report by Ruder Finn, e-commerce proved to be a major opportunity for luxury brands, in which online purchases amounted to 26 percent of luxury spending by mainland Chinese customers. Many luxury brands have a presence on Chinese online shops through both official and unofficial channels.

Besides Alibaba’s Tmall and JD.com, two multi-brand e-commerce platforms that have taken up a large portion of China’s online luxury retail pie, below are seven other popular luxury e-commerce sites international brands should know about to gain a better understanding of China’s e-luxury landscape.

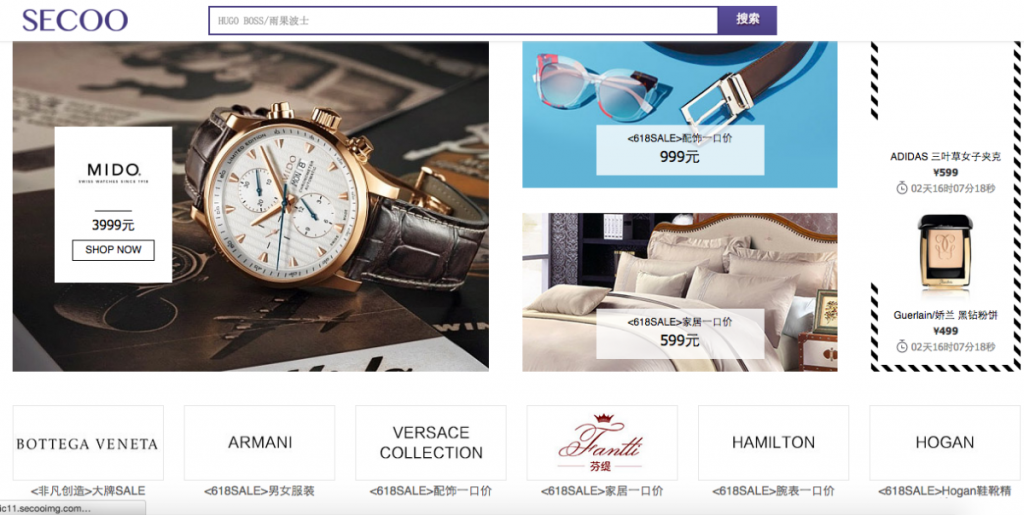

1. Secoo (Chinese e-commerce platforms)

Founded in 2008, Secoo (寺库) is one of the largest Chinese multi-brand luxury B2C sites. It currently operates under a partnership with Tencent in order to create data profiles for their more than 3 million registered shoppers.

Secoo specializes in luxury clothing and accessories for men and women from big-name brands, including Burberry, Miu Miu, Hermes, Rolex, Longines, and Bulgari. Additionally, to cater to Chinese consumers’ growing desire for a high-end lifestyle, the platform introduced cars from brands such as Bentley and Porsche as well as yachts and personal jets on the site. Secoo’s popularity is partly due to the fact that it offers payment methods specifically designed to be efficient for Chinese consumers, such as WeChat wallet.

The company approaches e-commerce with an omnichannel strategy, running its website and mobile app alongside offline boutiques located in both mainland China as well as Hong Kong, Milan, and Tokyo. When an order is made online, the item is shipped directly from abroad, and consumers can either have it delivered to their home or pick it up at Secoo’s stores in Beijing, Shanghai and Chengdu, where in some cases, according to L2, customers can have the authenticity of their purchases verified.

2. Mei.com (Chinese e-commerce platforms)

Launched in 2010 by Thibault Villet, Mei.com is a headliner in China’s luxury e-tail space for its leveraging of VR technology and experiential luxury. The flash sales site was able to expand its reach when it forged a partnership with Alibaba in 2015 to be on Tmall. It also gave Alibaba the backing of an established platform that had earned the respect of the more than 280 luxury brands that worked exclusively with it. The pair launched an online luxury channelfeaturing fashion shows highlighting curated looks from Mei.com’s designers, and the platform also boasts an e-magazine that inspires customers through lifestyle editorials.

3. Meici

Meici (美西, which translates to “Western beauty”) is a Shanghai-based luxury fashion e-commerce platform that launched in 2008 and operates under Sanpower Group—the same company that bought British department store House of Fraser in 2014. Meici stands out for its minimal black-and-white homepage design that organizes shopping categories by women’s, men’s, and kids’ fashion. The attention to kidswear taps into the growing expenditure Chinese parents are willing to make for their children. In addition to luxury brands such as Bally, Cartier, Dior, and Paul Smith, one can also find trending designer brands including Stuart Weitzman, Iceberg, and Circle.

Apart from its online platform and mobile app, Meici has a flagship store called “Meici Cafe” in the Mandarin Oriental hotel in Shanghai. If consumers are based in Shanghai, they can either make a purchase with online payment or cash on delivery from meici.com, or visit Meici Cafe and shop in store. Meici also runs an e-magazine called “Mzine” that offers customers the latest fashion tips and recommends “must-buy” items to its audience.

4. 5Lux (Chinese e-commerce platforms)

5Lux.com provides a comprehensive list of luxury goods to its visitors, from clothing and electronics, to food, wine, and stationery. In addition to international luxury brands like Rolex, Louis Vuitton, Gucci, Bally, and La Mer, 5Lux also hosts Coach, Kenzo, Tod’s, Kiehl’s, and many other renowned, but more accessible brands. The platform works with many of its brands to support an O2O model where customers can pick up their items purchased on the platform in store.

While many luxury brands are conservative or cautious about offering promotional sales online, 5Lux offers year-round discounts between 20 to 80 percent for different brands to incentivize China’s middle-class consumers to make and repeat purchases. Moreover, to keep up with the gift-giving culture in China, 5Lux has a dedicated page where consumers can browse gifts based on gender, price, occasion, the receiver’s hobbies, and even their shipping location.

5. Shangpin (Chinese e-commerce platforms)

Shangpin, whose Chinese characters mean “fashion” and “taste”, is a luxury e-commerce retailer that specializes in fashion and hosts brands including 3.1. Phillip Lim, Burberry, Gucci, Fendi, and Moschino. It also enjoys an exclusive agreement with the British high-street brand Topshop in China.

Like other domestic players in the Chinese e-commerce market, Shangpin understands how to drive its consumers’ shopping desire by leveraging the fan economy. Celebrities and KOLs (key opinion leaders) are an important source for luxury product recommendations for Chinese consumers, so under each shopping category, Shangpin features shopping guides that leverage celebrity influence. Shopping guide titles like “Popular Handbags Owned by Celebrities in 2017” give consumers inspiration from their favorite KOLs.

More recently, Shangpin has taken note of the growing influence and popularity of China’s own fashion designer scene by creating a separate channel on the platform that features a curated selection of 80 Chinese brands.

6. iHaveU (Chinese e-commerce platforms)

iHaveU is a luxury B2C platform founded in 2010 that features brands such as Prada, Burberry, Emporio Armani, Salvatore Ferragamo, and Versace. Unlike many other luxury e-retailers in China, iHaveU chooses to highlight designer home items, which include furniture and silverware, instead of cosmetics on its main navigation bar. It has even partnered with an Australian real estate agency to offer a home and condo-purchasing service to its high-income audience.

In 2016, iHaveU launched a new sub-website called “Global U Choice” that features skincare, personal care, health supplements, imported food, home items and maternal and baby products that are directly shipped from abroad. Not only is the company taking advantage of China’s growing demand for imported goods in these categories, but it has also been catching up with the mobile shopping trend by launching an online store on WeChat and its own mobile app.

While many B2C e-commerce sites face challenges in reassuring customers their luxury goods are authentic, iHaveU claims that every product on its website goes through five quality control processes before it reaches the hands of its buyer.

7. Xiu.com (Chinese e-commerce platforms)

After taking advantage of China’s luxury industry boom in 2008—and then later weathering its downturn—luxury fashion and cosmetics e-tailer Xiu.com remains one of China’s leading e-commerce sites to rival Secoo. Out of the luxury brands benchmarked by digital intelligence firm L2 in its latest Digital IQ Index: China Luxury report, Salvatore Ferragamo and Hugo Boss are some of the only labels with an official presence on the site, but the platform features nearly all of the luxury brands in L2’s report in an unofficial capacity.

Leave a Comment