Chinese consumer analysis

| The Chinese consumer is the smartest consumer we could find. They know the global price point for all of their favorite brands and are very sophisticated in their research. The consumer often starts researching their purchases months before they’re ready to buy. The average journey before purchase started 12 to 15 months BEFORE When we launch a brand that isn’t already activated in China, we have to adjust expectations because we’re essentially going to lose a year. But if you know that in advance, you can plan accordingly. |

Be careful:

9 out of 10 Western brands have Chinese consumers pegged as one homogenous group. So they often take a “one-size-fits-all” approach to market entry when hyper segmentation gets far better results. Their approach is flawed for a number of reasons, but even as an anthropology student, I fell prey to it as well.

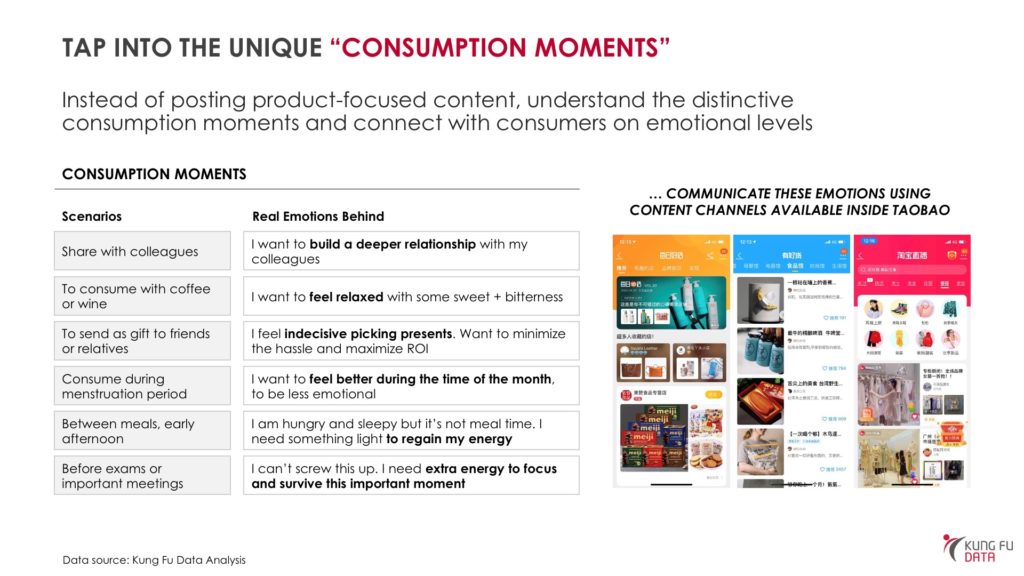

China is a big and complicated environment with over 450 minorities and dialects…and countless cultural idiosyncrasies, legacy systems and unique traditions that vary widely from place to place. Consumer groups are just as diverse and complex. A good place to start understanding them is in the unique consumption «moments.»

The most common error people make when thinking about entering China ecommerce is assuming that Tmall stands alone. It doesn’t.

Tmall is a STATUS SYMBOL in something much larger…a place where 670 million people begin and end their journey to buy nearly everything under the sun.

That place is Taobao.

Taobao has 80 million active store fronts and is a unique and all encompassing experience. It is C2C, B2C, M2C, DTC, B2B, B2B2C, M2B, M2B2C, M2B2C. It is not eBay. It is not a flea market.

Every permutation of buying and selling between individuals in China is represented. Here I can buy direct from brands AND factories.

When shopping, 90%+ of Chinese consumers use mobile Taobao to browse, interact, purchase, and write reviews. This is because Taobao is a platform where you can get access to ALL Alibaba channels (e.g. Tmall, Tmall Global, Tmall Supermarket, Suning, etc).

It’s an «all inclusive» platform. The largest and most successful online marketplace on earth.

This is what I mean:

Some key points about Chinese consumers:

- Young, free-spending consumers in lower tier cities are today’s growth engine.

This important set of consumers is unaffected by slowing growth and rising living costs and has an outsized impact on spending growth. - Most Chinese consumers are increasingly discerning, savvy,

and frugal about their spending.

Meaningful distinctions exist across how consumers are behaving and we highlight three additional consumer segments to take note of. - The health conscious movement is here to stay.

- A large majority of consumers say they are seeking a healthier lifestyle, which presents opportunities for companies to define what health really means.

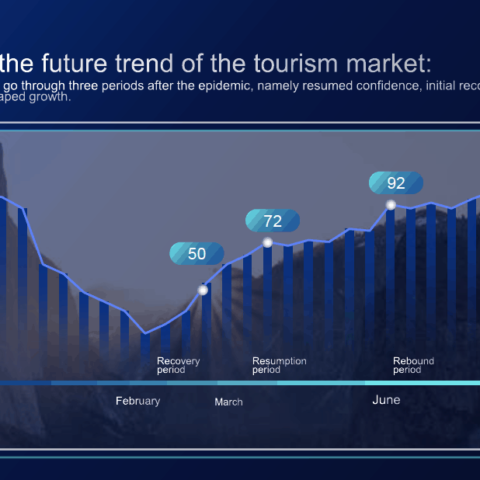

- Chinese consumers continue to be more sophisticated travelers.

- Consumers are moving away from the predictability and low prices of large group tours in favor of smaller, higher-end tours and self-guided adventures.

- High-end Chinese brands are increasingly appealing.

- Consumers want to connect with their cultural heritage and are willing to see Chinese brands as both desirable and high quality. This represents opportunities for both domestic brands and multinational players.

Do you want to be included in Chinese Journey purchase? Contact us

Leave a Comment