China’s Luxury Shoppers are rapidly growing

While many historic global luxury brands remain hesitant to embrace e-commerce as they strive to maintain their traditional heritage, Chinese luxury consumers show no such reluctance as they increasingly head online for their high-end shopping fix.

According to KPMG’s annual “China’s Connected Consumers” report released this week, Chinese luxury shoppers are showing rapidly growing demand for purchasing online. According to a survey of more than 10,000 online Chinese luxury shoppers, the average respondent’s spending went up 28 percent from last year for an average of 2,300 RMB (US$362) per transaction. In addition, they’re showing a willingness of between 75 and 95 percent to shop for most categories online with massively increased confidence in spending. Consumers said they would feel comfortable spending a maximum of 4,200 RMB online this year, a 121 percent jump from last year’s 1,900 RMB.

The main reason Chinese consumers are opting to buy online is still price—which is unsurprising given the massive size of the online daigou market. But the report found that bargain-hunting isn’t their only motivation, and other purchase drivers are opening the door for full-price online luxury boutiques. Their second most important reason for buying online is a point of origin from America or Europe, an increasingly important reason as overseas shipping becomes easier to access in China. This was followed by demand for unique items as well as better variety—two points that will be especially interesting to smaller niche labels and multi-brand online luxury boutiques.

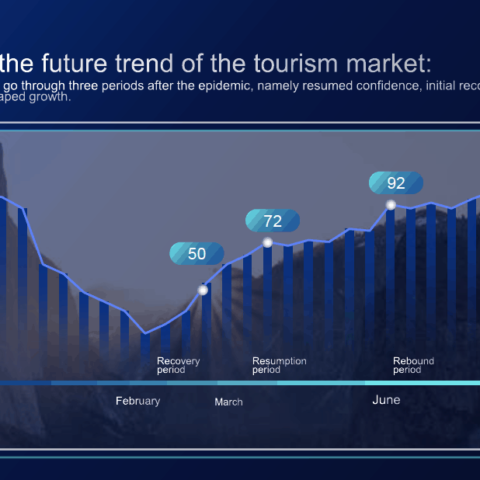

The findings of this paper echo what a growing body of industry experts is saying about e-commerce in China—luxury retailers that have been reluctant to dive into the world of online sales are set to miss out big-time when it comes to reaching Chinese consumers. In fact, the survey found that 45 percent of luxury shoppers surveyed now buy half of their luxury goods online, and it estimates that online shopping will generate 50 percent of China’s luxury consumption by 2020. If there’s one place where brands can still cash in on sales growth in the China market, the online sphere seems to be where the future lies.

Leave a Comment