Chinese Social Network

Our social media management agency offers expertise across Chinese social media networks and platforms. We are looking for growing, building and guiding a Chinese online community on social media.

Social media consultancy

Our social media consultants will work with your existing team to define what you need to do to nurture or grow your Chinese community to enhance your brand and to increase customer engagement.

Blockchain technology

CSM monetize your campaign through blockchain technology, creating and selling NFT with digital content created for the client.

Content Strategy and Creation

Our social media experts can help you create editorial planning systems to ensure the right content is delivered at the right time to keep your brand’s community engaged and to align with your wider social media strategy and marketing plans.

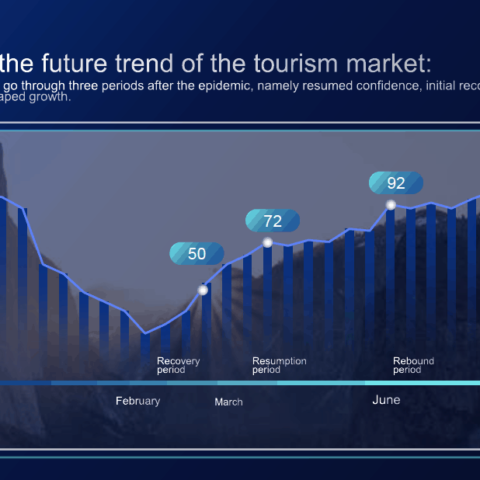

Social listening

Using industry-leading social listening tools, our data and community management experts can monitor keywords and track sentiment to bring insight to data generated about your brand through social media monitoring.

B2B Inside sales

CSM will generate quality leads in the Chinese market, connecting your company with new partners, distributors or clients.

China’s Social Media Market: Nearly a Billion Users — Mostly on Mobile

China is the world's largest social network market

china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network china social media network